Alternative Lending Companies Hallandale Beach

Alternative Lending Companies Hallandale Beach

Transactional Lending Near Me

Alternative lending for real estate has been around for decades and it utilized by people and corporations that get loans from non traditional methods. There are some great benefits for alternative lending, this includes: flexible options and providing more people the opportunity to qualify for a mortgage.

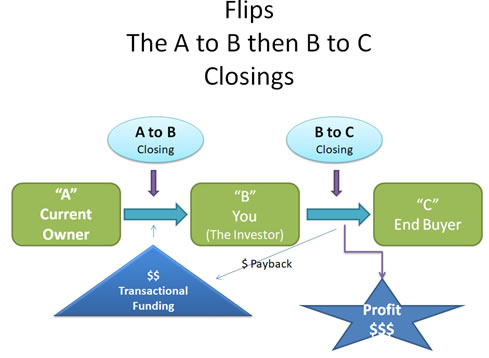

Alternative lenders work with title companies that are providing Transactional funding to real estate investors that are providing double closing's for real estate. To explain what a double closing, the buyers and sellers in the transaction are designated by the letters “A” (original property owner and seller), the investor “B” (both a buyer and seller), and the final buyer “C” who will be the final owner of the property.

It is also called Same Day Real Estate Closing or Double Closing because the actual time of this real estate transactions should happen on the same day. Depending on which state the property that is being sold is located in, different title companies may have different requirements to handle a flip. Once all the money and docs are in place for both transactions, they finish the transactional funder will fund the transactions to the title company handling the A to B transaction. Once the funds are received both transactions should close simultaneously and the transactional funder is paid back and the investor makes their profit.

What's In the News

Rand Merchant Bank (RMB), the corporate and investment banking arm of FirstRand pointed to a solid performance in its full-year financials, highlighting an 18% growth in core lending.

Pre-tax profit was up 17% from June 2021, and the ROE improved to 22.1% – up from 18.7% at June 2021, it said on Thursday (15 September).

“Our results showed a continued improvement in the credit quality of RMB’s core lending portfolio. We advanced R126 billion in new loans and refinancings across South Africa and broader Africa,” said RMB CEO James Formby.

The increase in client demand is a sign of improving confidence, especially as much of the funding is earmarked for South African investment, the bank said. “It is part of the reason that South Africa, and many of its businesses, are looking more attractive to investors again.”