Transactional Funding Miami

Transactional Funding Miami

Transactional Funding Near Me

Generally it is difficult for investors and wholesellers to get short-term loans quickly. This can be critical if a great potential deal is on the short term horizon. A lot of these short term loans are with unscrupolous lenders with super high interest rates and bad terms. Potentially, a transaction funding is a better choice in most cases for financing real estate transactions and other investment opportunities. Let us take an educated look at this as an option.

What is Transactional Funding

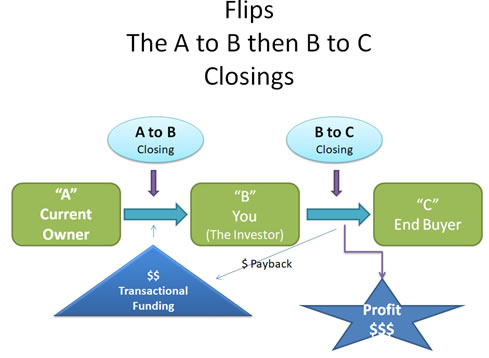

Transactional Funding is also known as "same day funing" or "flash funding". This is a specialized financial procedure which investors get very short term loans to complete transactions. These short term loans are paid back extremely quickly. In most cases these loans are paid back within a day or week time frame. The loans are paid back with profits from purchase of the property. These alternative forms of financing, investors and wholesellers are used to buy and sell high profit properties without risking their own savings.

What's In the News

Global Capital Partners Reviews Q3 Commercial Mortgage

As companies and investors move into the third quarter of the year, it is time to take a look at the commercial mortgage backed securities (CMBS) market.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. CMBS can provide liquidity to real estate investors and commercial lenders alike. Because there are no regulations for standardizing the structures of CMBS, their valuations can be difficult. The underlying securities of CMBS may include a number of commercial mortgages of varying terms, values, and property types—such as multi-family dwellings and commercial real estate. CMBS can offer less of a prepayment risk than residential mortgage-backed securities (RMBS), as the term on commercial mortgages is generally fixed.

As with collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO) CMBS are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the collateral in the event of default, with principal and interest passed on to investors. The loans are typically contained within a trust, and they are highly diversified in their terms, property types, and amounts. The underlying loans that are securitized into CMBS include loans for properties such as apartment buildings and complexes, factories, hotels, office buildings, office parks, and shopping malls, often within the same trust.