Here are the Benefits and Negatives to a "Double Closing's"

Double Closing Miami

Double Close Real Estate Near Me

Benefitss of a Double Closing

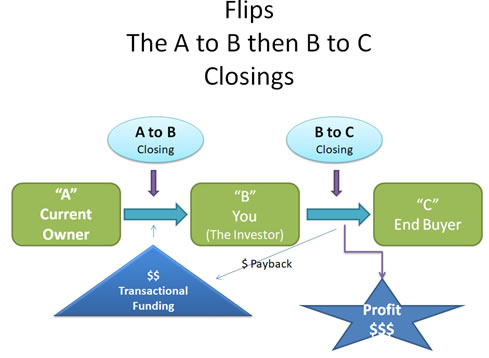

Double Closings have a lot of benefits. What different from the normal contract assignment is the double closing allows for more privacy. The seller are never aware of how much profit the investor is making, because the two completely seperate closing are happening at the same time and place. This is really important and beneficial if the investor is making a higher profit or if you are selling the property for a higher price than the original value thought by the seller.

It's crazy, but some sellers or buyers have known to back out of the deal, if they think the investor is making to much money. The double closing provides for privacy assuring that neither the seller or buyer know how much you are making.

Benefitss of a Double Closing

The cost of a double closing is generally more expensive then a simple assignment in order to cover the cost of the two closings. As the investor or the wholeseller you should be prepared and aware of this cost and factor that into your cost. In addition, the investor / wholeseller should be prepared to perform more work. The standard process for the closing is doubled. Bacically, everything that has to be done has to be done twice.

But, with all that taken into consideration to include increaased risk, the process is wll worth the effort because the investor can make much more on a deal then if they were doing a assignment deal. There are far less headaches from botht the seller and the buyer.

What's In the News

Global Capital Partners Reviews Q3 Commercial Mortgage

As companies and investors move into the third quarter of the year, it is time to take a look at the commercial mortgage backed securities (CMBS) market.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. CMBS can provide liquidity to real estate investors and commercial lenders alike. Because there are no regulations for standardizing the structures of CMBS, their valuations can be difficult. The underlying securities of CMBS may include a number of commercial mortgages of varying terms, values, and property types—such as multi-family dwellings and commercial real estate. CMBS can offer less of a prepayment risk than residential mortgage-backed securities (RMBS), as the term on commercial mortgages is generally fixed.

As with collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO) CMBS are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the collateral in the event of default, with principal and interest passed on to investors. The loans are typically contained within a trust, and they are highly diversified in their terms, property types, and amounts. The underlying loans that are securitized into CMBS include loans for properties such as apartment buildings and complexes, factories, hotels, office buildings, office parks, and shopping malls, often within the same trust.