Double Closing Real Estate Miami

Double Closing Real Estate Miami

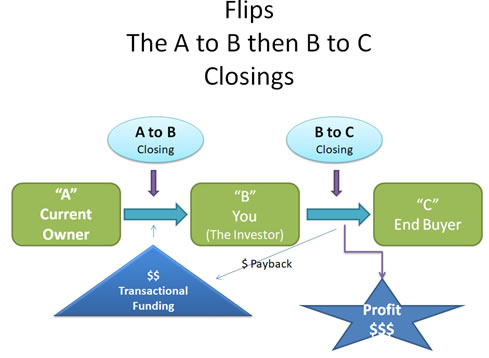

Double Closing Wholesaling

here are limitations however, which includes limitations on how funds can be used. For example, end buyers can no longer use the money used by the buyer to purchase the stated property from the official seller.

Not all Title companies are qualified to do double closings. The task requires skilled timing with a lot of moving procedures that govern the transaction. The Title company has to be investor friendly and seasoned in the process of the double closing in order for the process to go smoothly. Most title companies don't know what to do and how to do it, however, Quick Transactional Funding have done many complicated double closings. You can be assured that your transaction will go quickly and complete with result you need.

Real Investors utilize double closings because it is a very intelligent and creative way to complete and make profits from great deals. If your wholesaling distressed real estate or building a porfolio of passive income properties it is really the way to go. You have found a dependable partner in Quick Transactional Funding which will get the project done for you. Call them today.

What's In the News

Global Capital Partners Reviews Q3 Commercial Mortgage

As companies and investors move into the third quarter of the year, it is time to take a look at the commercial mortgage backed securities (CMBS) market.

Commercial mortgage-backed securities (CMBS) are fixed-income investment products that are backed by mortgages on commercial properties rather than residential real estate. CMBS can provide liquidity to real estate investors and commercial lenders alike. Because there are no regulations for standardizing the structures of CMBS, their valuations can be difficult. The underlying securities of CMBS may include a number of commercial mortgages of varying terms, values, and property types—such as multi-family dwellings and commercial real estate. CMBS can offer less of a prepayment risk than residential mortgage-backed securities (RMBS), as the term on commercial mortgages is generally fixed.

As with collateralized debt obligations (CDO) and collateralized mortgage obligations (CMO) CMBS are in the form of bonds. The mortgage loans that form a single commercial mortgage-backed security act as the collateral in the event of default, with principal and interest passed on to investors. The loans are typically contained within a trust, and they are highly diversified in their terms, property types, and amounts. The underlying loans that are securitized into CMBS include loans for properties such as apartment buildings and complexes, factories, hotels, office buildings, office parks, and shopping malls, often within the same trust.