Double Closing Real Estate Miami

Double Closing Real Estate Miami

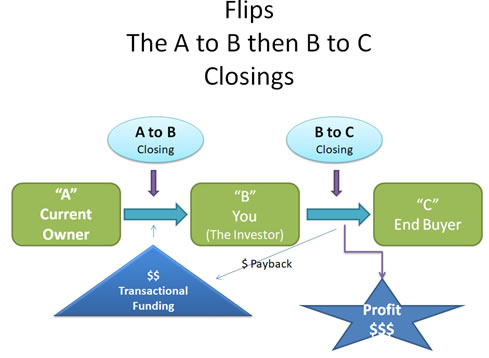

Double Closing Wholesaling

here are limitations however, which includes limitations on how funds can be used. For example, end buyers can no longer use the money used by the buyer to purchase the stated property from the official seller.

Not all Title companies are qualified to do double closings. The task requires skilled timing with a lot of moving procedures that govern the transaction. The Title company has to be investor friendly and seasoned in the process of the double closing in order for the process to go smoothly. Most title companies don't know what to do and how to do it, however, Quick Transactional Funding have done many complicated double closings. You can be assured that your transaction will go quickly and complete with result you need.

Real Investors utilize double closings because it is a very intelligent and creative way to complete and make profits from great deals. If your wholesaling distressed real estate or building a porfolio of passive income properties it is really the way to go. You have found a dependable partner in Quick Transactional Funding which will get the project done for you. Call them today.

What's In the News

Non-banks explain higher interest rate hikes

The official cash rate went up for a fifth time in September, invoking a flurry of interest rate hikes as lenders pass on the increased cost to borrowers.

But while most have matched the Reserve Bank’s 0.50% hike, interest rates on Firstmac home loan products increased by 0.60%, while AFG Home Loans increased interest rates in July, August and September, with increases ranging from 0.50% and 0.62%.

Headquartered in Brisbane, family-owned non-bank lender Firstmac has increased variable home loan rates by 0.60%, effective for new and existing customers from September 9.