Alternative Lending Companies Miami Gardens

Alternative Lending Companies Miami Gardens

Transactional Lending Near Me

Alternative lending for real estate has been around for decades and it utilized by people and corporations that get loans from non traditional methods. There are some great benefits for alternative lending, this includes: flexible options and providing more people the opportunity to qualify for a mortgage.

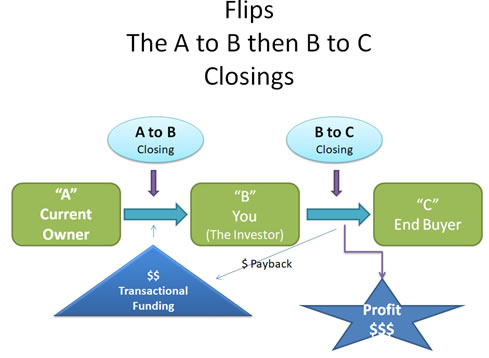

Alternative lenders work with title companies that are providing Transactional funding to real estate investors that are providing double closing's for real estate. To explain what a double closing, the buyers and sellers in the transaction are designated by the letters “A” (original property owner and seller), the investor “B” (both a buyer and seller), and the final buyer “C” who will be the final owner of the property.

It is also called Same Day Real Estate Closing or Double Closing because the actual time of this real estate transactions should happen on the same day. Depending on which state the property that is being sold is located in, different title companies may have different requirements to handle a flip. Once all the money and docs are in place for both transactions, they finish the transactional funder will fund the transactions to the title company handling the A to B transaction. Once the funds are received both transactions should close simultaneously and the transactional funder is paid back and the investor makes their profit.

What's In the News

Non-banks explain higher interest rate hikes

The official cash rate went up for a fifth time in September, invoking a flurry of interest rate hikes as lenders pass on the increased cost to borrowers.

But while most have matched the Reserve Bank’s 0.50% hike, interest rates on Firstmac home loan products increased by 0.60%, while AFG Home Loans increased interest rates in July, August and September, with increases ranging from 0.50% and 0.62%.

Headquartered in Brisbane, family-owned non-bank lender Firstmac has increased variable home loan rates by 0.60%, effective for new and existing customers from September 9.