Transactional Funding Miami

Transactional Funding Lauderhill

Transactional Funding Near Me

Generally it is difficult for investors and wholesellers to get short-term loans quickly. This can be critical if a great potential deal is on the short term horizon. A lot of these short term loans are with unscrupolous lenders with super high interest rates and bad terms. Potentially, a transaction funding is a better choice in most cases for financing real estate transactions and other investment opportunities. Let us take an educated look at this as an option.

What is Transactional Funding

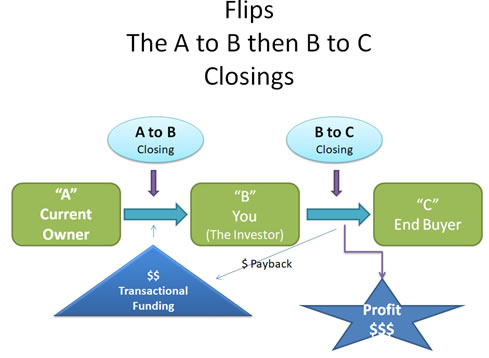

Transactional Funding is also known as "same day funing" or "flash funding". This is a specialized financial procedure which investors get very short term loans to complete transactions. These short term loans are paid back extremely quickly. In most cases these loans are paid back within a day or week time frame. The loans are paid back with profits from purchase of the property. These alternative forms of financing, investors and wholesellers are used to buy and sell high profit properties without risking their own savings.

What's In the News

How Much Is A Down Payment On A House?

The amount you should put down when you’re buying a home is a personal decision that depends on what’s best for your finances. You have to put down some minimum amount to qualify for a mortgage. For a conventional mortgage, that amount is usually 3% of the home’s price.

You might want to put down more than that because you have to pay interest to borrow money. The more you borrow, the more you pay. At the same time, you don’t want your down payment to be so large that it leaves you with too little savings. Most homebuyers also want enough cash after closing to do things like buy new furniture or paint the walls.