Funding Real Estate Deals

Funding Real Estate Deals in Lauderhill

Extended Transactional Funding Near Me

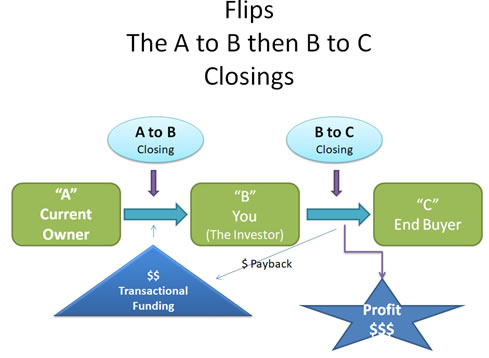

Funding a double closing has one of two ways that they are done in todays environment.

In the first case the person or entity purchasing the property brings funds to purchase the property and the Investore / wholeseller takes those funds and uses them to fund the closing of the first deal at the same time of the other closing. Florida still allows this process while other states have discontinued this process. So, investors and wholesellers can use their own money or they can locate transactional funding.

The other process is called transactional funding where the lender provides the full amount of the transaction needed to complete the first deal. This allows the investor to be able to complete the second transaction without having to use any of it's own capital. The Transactional Funding Lender simply charges a fee which is equal to a percentage of the transaction. The fees however, are generally more than the normal back rates. Which if you are an investor you are generally not surprised.

Different from hard money lenders, the transactional funding lenders regularly require a fast turnaround time in order to get their money back. This means that a double closing must take place with in 1 to 2 days and be completed.

What's In the News

How Much Is A Down Payment On A House?

The amount you should put down when you’re buying a home is a personal decision that depends on what’s best for your finances. You have to put down some minimum amount to qualify for a mortgage. For a conventional mortgage, that amount is usually 3% of the home’s price.

You might want to put down more than that because you have to pay interest to borrow money. The more you borrow, the more you pay. At the same time, you don’t want your down payment to be so large that it leaves you with too little savings. Most homebuyers also want enough cash after closing to do things like buy new furniture or paint the walls.