Double Closing Real Estate Miami

Double Closing Real Estate Miami

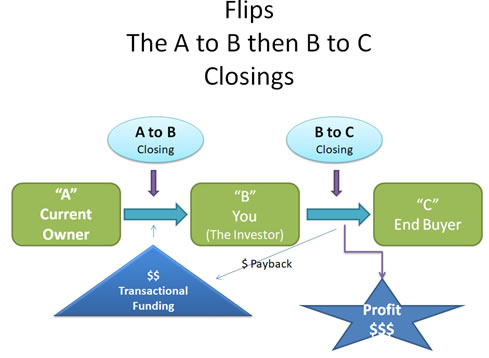

Double Closing Wholesaling

here are limitations however, which includes limitations on how funds can be used. For example, end buyers can no longer use the money used by the buyer to purchase the stated property from the official seller.

Not all Title companies are qualified to do double closings. The task requires skilled timing with a lot of moving procedures that govern the transaction. The Title company has to be investor friendly and seasoned in the process of the double closing in order for the process to go smoothly. Most title companies don't know what to do and how to do it, however, Quick Transactional Funding have done many complicated double closings. You can be assured that your transaction will go quickly and complete with result you need.

Real Investors utilize double closings because it is a very intelligent and creative way to complete and make profits from great deals. If your wholesaling distressed real estate or building a porfolio of passive income properties it is really the way to go. You have found a dependable partner in Quick Transactional Funding which will get the project done for you. Call them today.

What's In the News

How Much Is A Down Payment On A House?

The amount you should put down when you’re buying a home is a personal decision that depends on what’s best for your finances. You have to put down some minimum amount to qualify for a mortgage. For a conventional mortgage, that amount is usually 3% of the home’s price.

You might want to put down more than that because you have to pay interest to borrow money. The more you borrow, the more you pay. At the same time, you don’t want your down payment to be so large that it leaves you with too little savings. Most homebuyers also want enough cash after closing to do things like buy new furniture or paint the walls.