Double Closing Real Estate Miami

Double Closing Real Estate Miami

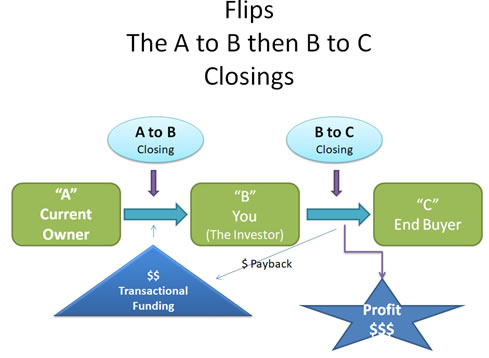

Double Closing Wholesaling

here are limitations however, which includes limitations on how funds can be used. For example, end buyers can no longer use the money used by the buyer to purchase the stated property from the official seller.

Not all Title companies are qualified to do double closings. The task requires skilled timing with a lot of moving procedures that govern the transaction. The Title company has to be investor friendly and seasoned in the process of the double closing in order for the process to go smoothly. Most title companies don't know what to do and how to do it, however, Quick Transactional Funding have done many complicated double closings. You can be assured that your transaction will go quickly and complete with result you need.

Real Investors utilize double closings because it is a very intelligent and creative way to complete and make profits from great deals. If your wholesaling distressed real estate or building a porfolio of passive income properties it is really the way to go. You have found a dependable partner in Quick Transactional Funding which will get the project done for you. Call them today.

What's In the News

Mortgage rates hit 6%, first time since 2008 housing crash

WASHINGTON — Average long-term U.S. mortgage rates climbed over 6% this week for the first time since the housing crash of 2008, threatening to sideline even more homebuyers from a rapidly cooling housing market.

Mortgage buyer Freddie Mac reported Thursday that the 30-year rate rose to 6.02% from 5.89% last week. The long-term average rate has more than doubled since a year ago and is the highest it's been since November of 2008, just after the housing market collapse triggered the Great Recession. One year ago, the rate stood at 2.86%.